Understanding DAC8 & CARF

Beyond the EU, the Crypto-Asset Reporting Framework (CARF) has been endorsed by 58+ countries including the UK, Canada, Australia, Singapore, and New Zealand, making DAC8 and CARF compliance part of a global crypto tax reporting framework

Under DAC8 and CARF, crypto exchanges, brokers, wallet providers, and digital asset platforms must automatically gather user tax residency information, transaction details, and wallet addresses. This information is then reported to tax authorities to increase transparency, improve cross-border monitoring, and combat tax evasion in the crypto-asset market.

DAC8 is the EU's implementation of the OECD's Crypto-Asset Reporting Framework (CARF), effective from January 1, 2026. It requires Reporting Crypto-Asset Service Providers (RCASPs) to collect, verify, and report crypto-asset transaction data directly to EU tax authorities

Are you affected?

If your platform operates as a Reporting Crypto-Asset Service Provider (RCASP) facilitating crypto-asset transactions for EU residents, you are obligated to report comprehensive details about your users and their transactions. This includes tax residency information, wallet addresses, transaction types and amounts, and the fair market value of crypto-assets exchanged

Consult the checklist below to determine whether your company is affected!

We can help you get and stay compliant with DAC8 & CARF

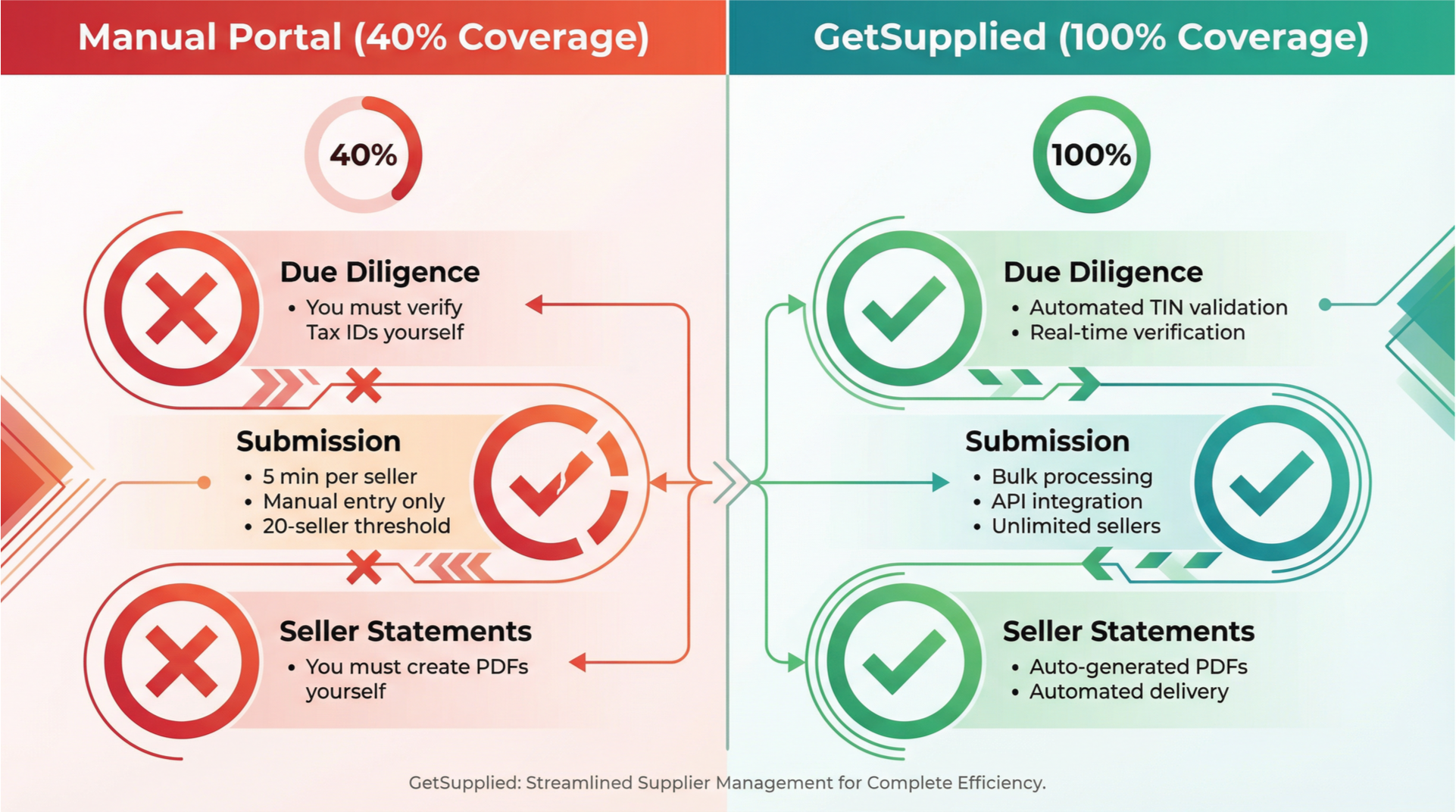

Supplied automates the entire onboarding, due diligence, and reporting process for you to achieve full DAC8 and CARF compliance. Saving you time and reducing the risk of fines.

50+ Companies already saving costs

Why it was implemented...

DAC8 and CARF are regulatory frameworks adopted by the EU and OECD to improve the exchange of information and cooperation between tax authorities globally.

They build upon the success of previous directives by expanding the scope of administrative cooperation to cover crypto-assets, which previously operated outside traditional financial reporting systems

Enhancing tax transparency: DAC8 and CARF aim to enhance tax transparency by ensuring that relevant tax information on crypto-asset transactions is shared effectively between jurisdictions. This allows tax authorities to have a comprehensive view of taxpayers' crypto activities across borders, reducing the opportunities for tax evasion and aggressive tax planning in the digital asset space.

Combating tax avoidance and evasion: DAC8 and CARF strengthen the global fight against tax avoidance and evasion by establishing rules for the automatic exchange of crypto-asset transaction information. This facilitates the identification of unreported crypto income and helps tax authorities take appropriate measures to counter tax evasion practices that exploit the pseudonymous nature of blockchain transactions

Consequences

Consequences include penalties and fines ranging from EUR 20,000 to EUR 500,000, platform restrictions, reputational risks, and increased audits.

Penalties and fines

Failure to comply with DAC8 obligations may result in substantial penalties and fines imposed by tax authorities, ranging from EUR 20,000 to EUR 500,000 depending on the severity and jurisdiction. The EU has established minimum penalty standards to ensure consistent enforcement across member states.

Reputational risks

Non-compliance with tax regulations can tarnish the reputation of businesses and individuals, leading to loss of trust among customers, partners, and stakeholders. This can have long-term negative effects on business operations and growth.

Platform restrictions

Under DAC8, if a customer fails to provide required self-certification forms after two reminders, RCASPs must block the customer from performing reportable transactions within 60 days. This unique enforcement mechanism can significantly impact platform operations and user experience.

Increased scrutiny and audits

Non-compliant entities may face increased scrutiny and audits by tax authorities, leading to additional costs, disruptions to business activities, and potential legal consequences.

Tips for implementation...

Implementing DAC8 and CARF can be a complex and time-consuming process for crypto-asset service providers. It requires careful consideration of reporting obligations, transaction data management, user verification systems, and ensuring compliance with the frameworks' provisions. However, working with compliance partners can significantly alleviate the burden and reduce costs associated with implementing DAC8 and CARF in-house.

The Benefits of working with compliance partners like Supplied include:

1

Understanding reporting obligations

Compliance partners specialize in interpreting crypto regulatory requirements and can help businesses understand their specific reporting obligations under DAC8 and CARF. They stay up-to-date with the latest developments across multiple jurisdictions and provide guidance on what transaction information needs to be reported, to whom, and by when.

2

Data management and automation

DAC8 and CARF involve collecting, processing, and sharing vast amounts of crypto transaction data including wallet addresses, transaction types, fair market values, and user tax residency information. Compliance partners can assist businesses in developing efficient data management systems and automation processes. This ensures accurate and timely reporting, minimizing the risk of errors and penalties.

3

Expertise and guidance

Compliance partners possess in-depth knowledge of DAC8, CARF, and related crypto tax regulations across multiple jurisdictions. They can provide businesses with expert guidance on how to navigate the complexities of these frameworks, interpret legal requirements, handle self-certification processes, manage user blocking requirements, and develop compliant processes tailored to the specific needs of crypto-asset service providers.

4

Cost-effective solutions

Implementing DAC8 and CARF in-house can be resource-intensive, requiring dedicated compliance personnel, technology investments, blockchain data infrastructure, and ongoing training. Our customers reported cost increases by over 15% to support crypto compliance requirements. Compliance partners offer cost-effective solutions that leverage their expertise and technology platforms, reducing the overall burden on internal resources.

Trusted by businesses of all sizes

Security & Trust

Your data is always protected

Reduce risk, accelerate onboarding, and stay globally compliant, all through one API.

Join us

Start your compliance journey

Reduce risk, accelerate onboarding, and stay globally compliant, all through one API.

50+ Companies already saving costs